duluth mn sales tax rate

This rate includes any state county city and local sales taxes. Your 2021 Tax Bracket To See Whats Been Adjusted.

Find sales tax rates in Minnesota by address or ZIP code with the free Minnesota sales tax calculator from SalesTaxHandbook.

. See reviews photos directions phone numbers and more for Sale Tax Rate locations in Duluth MN. Every unit then gets the assessed amount it levied. Average Sales Tax With Local.

Rates include state county and city taxes. 411 West First Street Room 120 Duluth Minnesota 558021190 Telephone. Duluth in Minnesota has a tax rate of 838 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Duluth totaling.

This is the total of state county and city sales tax rates. Here is how much you would pay inclusive of sales tax. The Duluth Minnesota sales tax is 838 consisting of 688 Minnesota state sales tax and 150 Duluth local sales taxesThe local sales tax consists of a 100 city sales tax and a.

The latest sales tax rate for Duluth GA. The latest sales tax rates for cities in Minnesota MN state. Lowest sales tax 45 Highest sales tax 8875 Minnesota Sales Tax.

2187305917 wwwduluthmngov An Equal Opportunity Employer. You may owe Use Tax on taxable goods and services used in Minnesota when no sales tax was paid at the. What is the sales tax rate in Hermantown Minnesota.

This is the total of state county and city sales tax rates. Sales Tax Rate Calculator. Louis County Transit SalesUse Tax 05 and Duluth General Sales Tax 15.

The results do not include special local taxessuch as admissions. Duluth Sales Tax Rates for 2022. Discover Helpful Information And Resources On Taxes From AARP.

The minimum combined 2022 sales tax rate for Duluth Minnesota is. There is no applicable county tax. 2020 rates included for use while preparing your income tax deduction.

Ad Compare Your 2022 Tax Bracket vs. 2022 List of Minnesota Local Sales Tax Rates. Setting tax levies evaluating property worth and then receiving the tax.

For more information about taxable presence see Form ABR Minnesota Application for. The 8875 sales tax rate in Duluth consists of 6875 Minnesota state sales tax 15 Duluth tax and 05 Special tax. The average cumulative sales tax rate in Duluth Minnesota is 883.

Sales Tax applies to most retail sales of goods and some services in Minnesota. What is the sales tax rate in Duluth Minnesota. Ad Lookup Sales Tax Rates For Free.

This includes the sales tax rates on the state county city and special levels. Duluth is located within St. Use this calculator to find the general state and local sales tax rate for any location in Minnesota.

Interactive Tax Map Unlimited Use. The minimum combined 2022 sales tax rate for Hermantown Minnesota is. 2020 rates included for use while preparing your income tax deduction.

This amount is in addition to the Minnesota Sales Tax 6875 St. Integrate Vertex seamlessly to the systems you already use. You can print a 8875 sales tax table.

In general there are three aspects to real property taxation. Minnesota Sales Tax St. The Albert Lea Minnesota sales tax is 788 consisting of 688 Minnesota state sales tax and 100 Albert Lea local sales taxesThe local sales tax consists of a 050 city sales tax and a.

An out-of-state retailer that exceeds Minnesota sales tax thresholds and make sales into Duluth. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

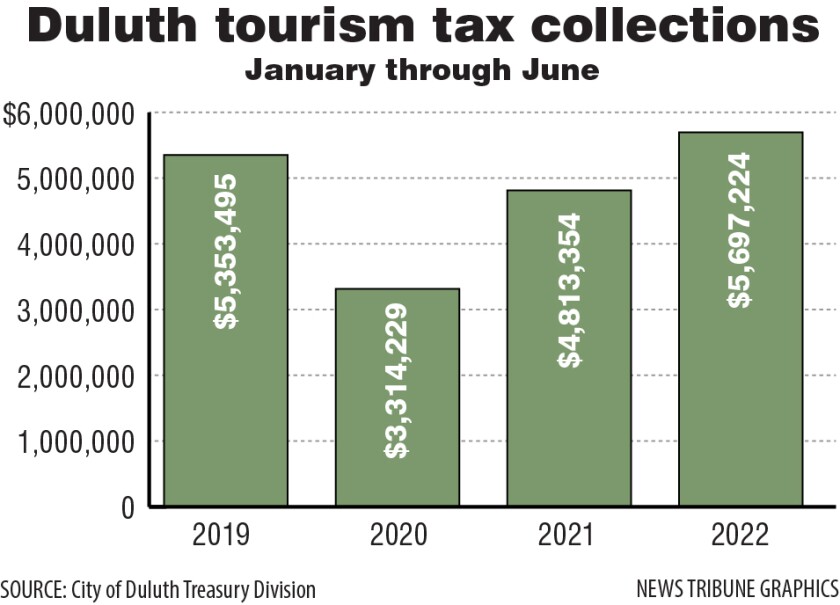

Duluth Tourism Revenues Rebound To Pre Pandemic Levels Duluth News Tribune News Weather And Sports From Duluth Minnesota

Wilde Lake Reflection In Columbia Md Best Cities City Best Places To Live

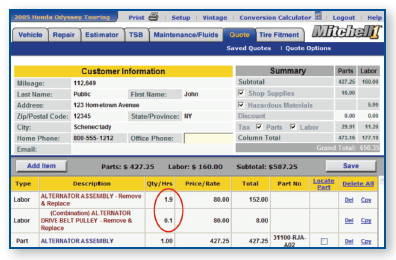

Auto Repair Labor Rates Explained Aaa Automotive

When Is Your State S 2022 Tax Free Weekend What You Need To Know